Kuala Lumpur, Malaysia (May 30, 2023) – Unsettling evidence of potential financial irregularities within YNH Property Bhd (KLSE: YNHPROP) has prompted investigative journalists and stakeholders to call on the Securities Commission Malaysia (SC) to initiate a thorough investigation. This comes amid growing concerns over the company’s possible breaches of Bursa Malaysia Listing Requirements and the Capital Markets and Services Act 2007. Link to the YNH Announcement at the bottom of this article:

The urgency for an in-depth probe escalated after YNH Property Bhd admitted to an oversight: “We acknowledge our oversight of such announcement and shall seek advice from the Adviser to rectify this oversight.” This unprecedented admittance has thrown the spotlight on the governance and financial integrity of the entity. Links to the SC inquiries at the bottom of this article:

The Directors of YNH are not new comers to the regulations and do not simply overlook Bursa requirements. The announcements were not made likely because the deals proposed in the announcements were fabricated and back dated to support the coverup of recently disclosed news reports of the property in question and the missing RM 239.5 million. (story below)

In addition to the questions posed by the SC, Shareholders want to ask the following and hope that the SC will assist in requiring urgent and transparent responses. These are not just mere queries but an echo of shareholder concerns:

- Can YNH provide a clear and detailed justification, backed with documentary evidence, for each transaction involving the company and its associated entities?

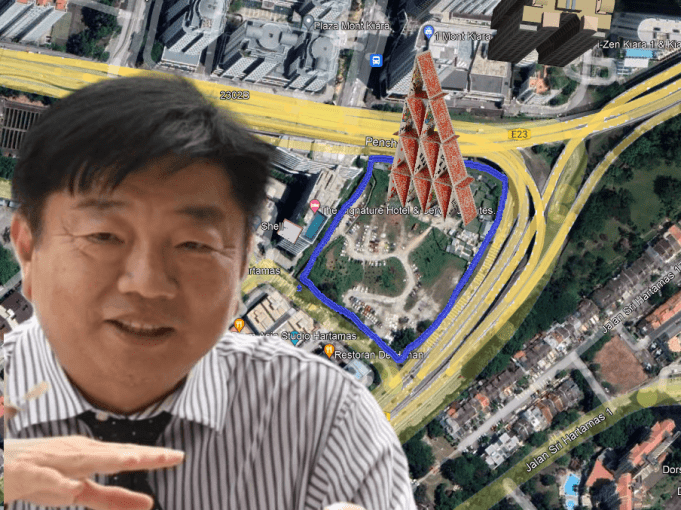

- Why were substantial funds transferred with no apparent development work taking place on the property, as evidenced by the lack of progress despite several significant Joint Venture Deposit traunches made totaling RM 239.5 million?

- Could YNH explain the timing and reasoning behind the company and Rapid changing their financial year end just days before the annual reports were due to be published that include the activities reported in this transaction?

- How were potential conflicts of interest managed, considering the extensive involvement of Yu family members in the transactions?

- Can YNH demonstrate its tax compliance, particularly whether Capital Gains Taxes or Profits Taxes that might have arisen from these transactions were appropriately paid and reported?

- Could the company disclose the full details and rationale behind the use of third-party collateral for loans for Kar Sin Bhd, particularly when the collateral seems to be controlled by members of the Yu family?

- How can YNH explain the allegations of personal gain by Yu Kuan Chon and Yu Kuan Huat, with personal loans and further undisclosed transactions?

- Can YNH explain how it can report this property in the 2019 Annual report as a part of its landbank, when at this time you sate on the record that it in not a related party transaction

- Can YNH show that the family members that are directors of the various companies involved in this transaction are somehow not subordinate to members of the YNH board of Directors and therefore not persons connected and related parties?

Under the Bursa Malaysia Listing Requirement 9.19, companies must disclose any information necessary to prevent a false market in its securities or that would likely materially affect the price or value of its securities. These allegations, if true, clearly merit full disclosure to ensure transparency and compliance.

Further scrutiny is being directed towards YNH’s Board of Directors. How were they not aware, or why did they permit the Yu family to allegedly benefit from related party collateral, along with the use of RM 239.5 Million for a development project that hasn’t commenced for years, resulting in an incurred debt exceeding RM 50 Million in interest at the expense of shareholders?

Sections 132 and 133 of the Capital Markets and Services Act 2007 obligate directors to act in the best interests of the company and its shareholders. The involvement and oversight of the board in these transactions are, therefore, under severe scrutiny.

The potential tax implications of these transactions are alarming, particularly the apparent disappearance of substantial funds. A detailed investigation into the use of these funds is warranted, including if any part of these funds were used in any attempt to manipulate the share price of YNH using its own capital.

This reporter firmly believes that the implicated Yu family members were fully aware of their actions when they allegedly misused YNH’s capital. Such actions merit not just a thorough investigation, but serious consideration for a potential criminal breach of trust. Directors of a public company are invariably held to a higher standard and must adhere to stringent financial regulations. Using public funds, derived from bonds and public debt for personal gain, is strictly prohibited. Given the experience of the directors on YNH’s board, it’s indisputable that they should be aware of the substantial risk associated with such activities and be held personally accountable.

Moreover, there are serious concerns over the proposed transaction, seen by some as a move to conceal the missing funds. Any sale of the land should only be permitted after the full return of the allegedly missing funds, in view of the possible detriment to the shareholders. It is clear the YNH has no development on this property like so many others. The SC should require a full refund of the RM 239.5 million prior to allowing this transaction to proceed. If they can’t return it with imediate effect, then why is it actually listed as an asset on the books right next to more than RM 1 billion in other like JV deposits payments to non-existing projects?

Amid these allegations, a comprehensive forensic investigation by an independent authority is being demanded. Such an investigation would aim to review the facts, take appropriate corrective actions, and hold those responsible accountable for any misconduct.

The situation starkly emphasizes the importance of corporate transparency, minority shareholder rights, and strict adherence to financial regulations. As the story unfolds, the attention now turns to the SC for its response and potential action. Stay tuned for more updates as we continue our scrutiny of these disturbing revelations.

(The origional YNH Announcement) http://ynhb.listedcompany.com/news.html/id/2440500

(First 26 Questions and Answers to the SC Inquiry) http://ynhb.listedcompany.com/news.html/id/2440961

(second 7 Questions and Answers to the SC Inquiry) http://ynhb.listedcompany.com/news.html/id/2441855